Many of you are wondering:

How do I pick contracts using advanced LaBute indicators?

This is the big and important question for the majority, whether users of indicators or those interested in indicators, and we will answer with ease and detail with all the steps that our team takes in selecting contracts.

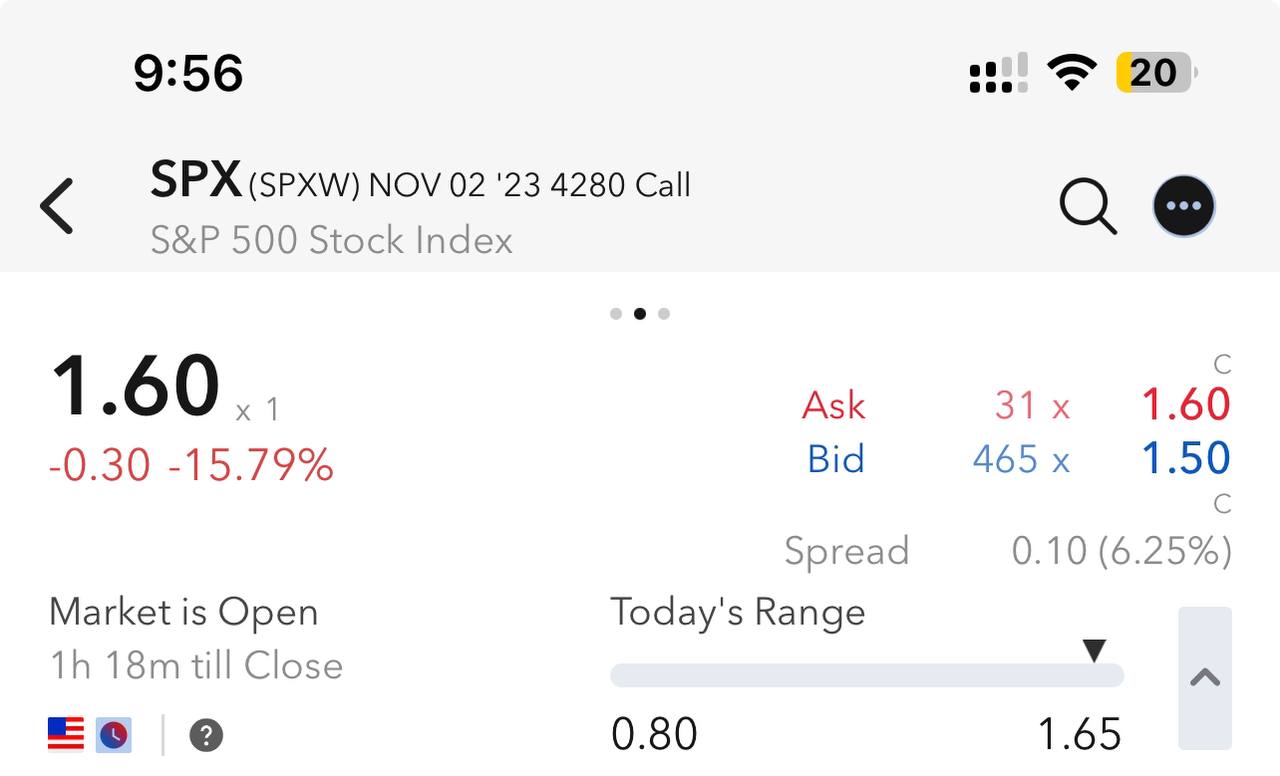

With the beginning of the market opening on Monday, October 30, 2023, we reviewed the 4-hour SPAX frame (which is the frame we always use in trading options and digital currencies).

The date for announcing the interest rate is Wednesday, November 1, 2023. Most expectations indicate a stabilization of the interest rate and thus a recovery in the financial markets ( just expectations that you should not always rely on )

Now we are working on the chart to determine the goals of our contracts as follows:

It appears to you that the trend is down in general, but the Labot indicators for peaks and troughs at the bottom showed a green dot , which indicates oversold saturation, which gives a hint that there is a rebound, even if the 4-hour candle is green! We have drawn ( the trend line in yellow )

Note: The white lines are resistance lines drawn previously.

We selected the following two contracts:

Cole Spax 4280 Strike November 2, 2023

Cole Spax 4280 Strike November 3, 2023

- All of these things happened on Monday, October 30, namely technical analysis and searching for expectations for the interest rate. We were hoping that it would breach the trend line (yellow line), and upon breaching it, it would be retested, and that the expectations for stabilizing interest would be correct, which would contribute to the recovery of the SPACX index.

On the same day, Monday, a breach of the downtrend (yellow line) actually occurred, and the LaBute advanced peaks and bottoms indicators also continue to be positive upwards and attempt to exit the lower area. Notice the following picture:

The next day, Tuesday, October 31, 2023, the LaBute Advanced Indicators issued a buy signal (COL).

Which strengthened our confidence in our deals, and we consider the technical conditions for the rise to have been completed, praise be to God, but caution must be taken.

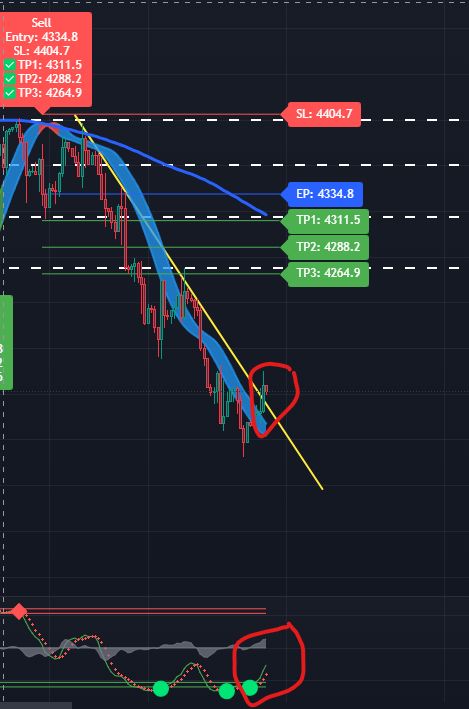

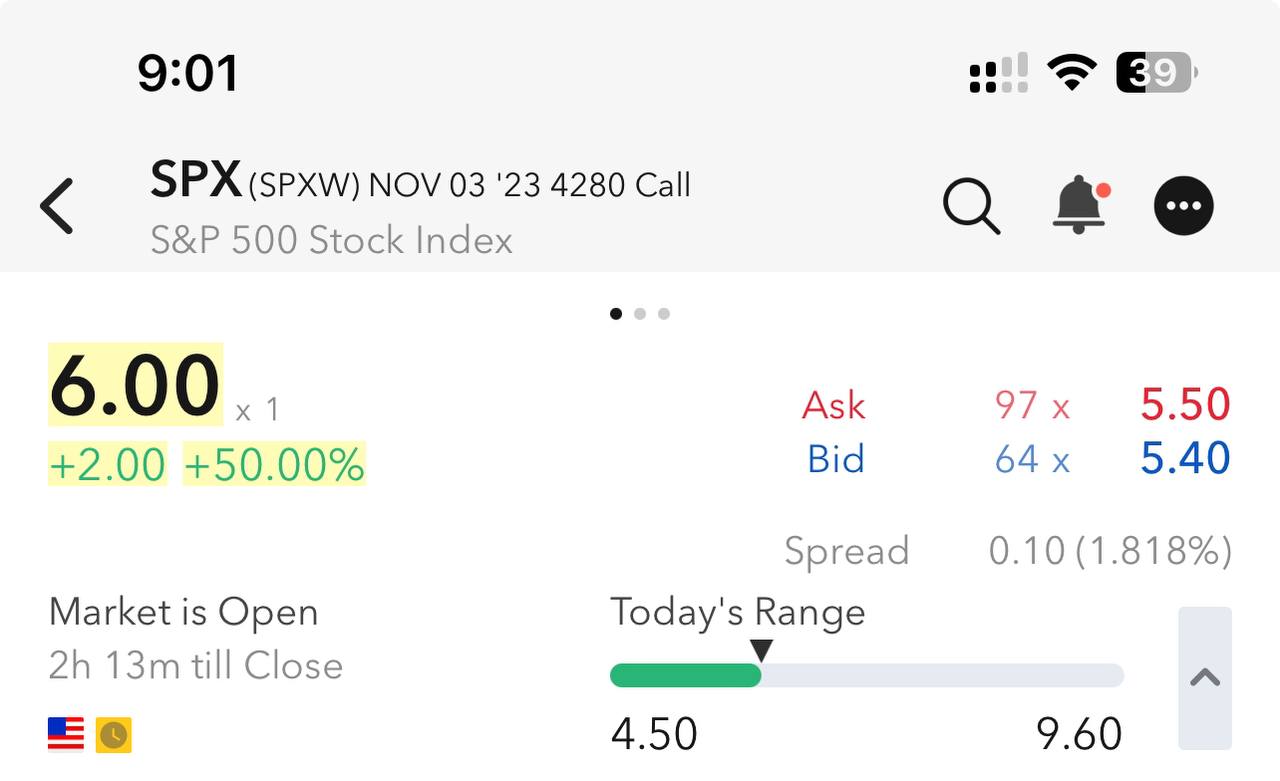

On Wednesday, November 1, 2023, we noticed a response to our contracts, and they were at these prices:

- We have now raised the stop prices to the same entry price and a little more to include the platform’s commission at the time of landing and selling.

Then it was announced that the interest rate would be fixed.

With the stabilization of US Federal Reserve interest rates, the SPACX index rebounded unexpectedly and rose significantly, achieving all the goals of the advanced Labbott indices within just two days, on November 2, 2023.

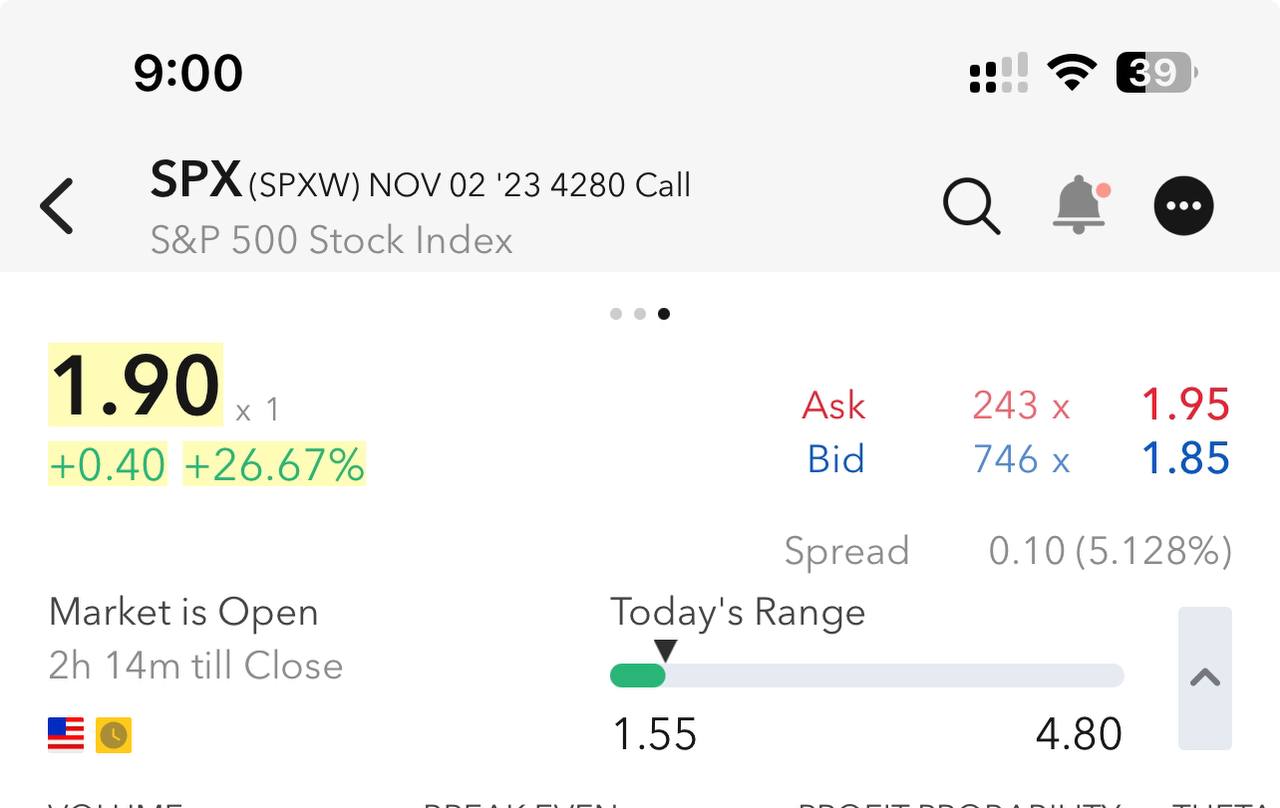

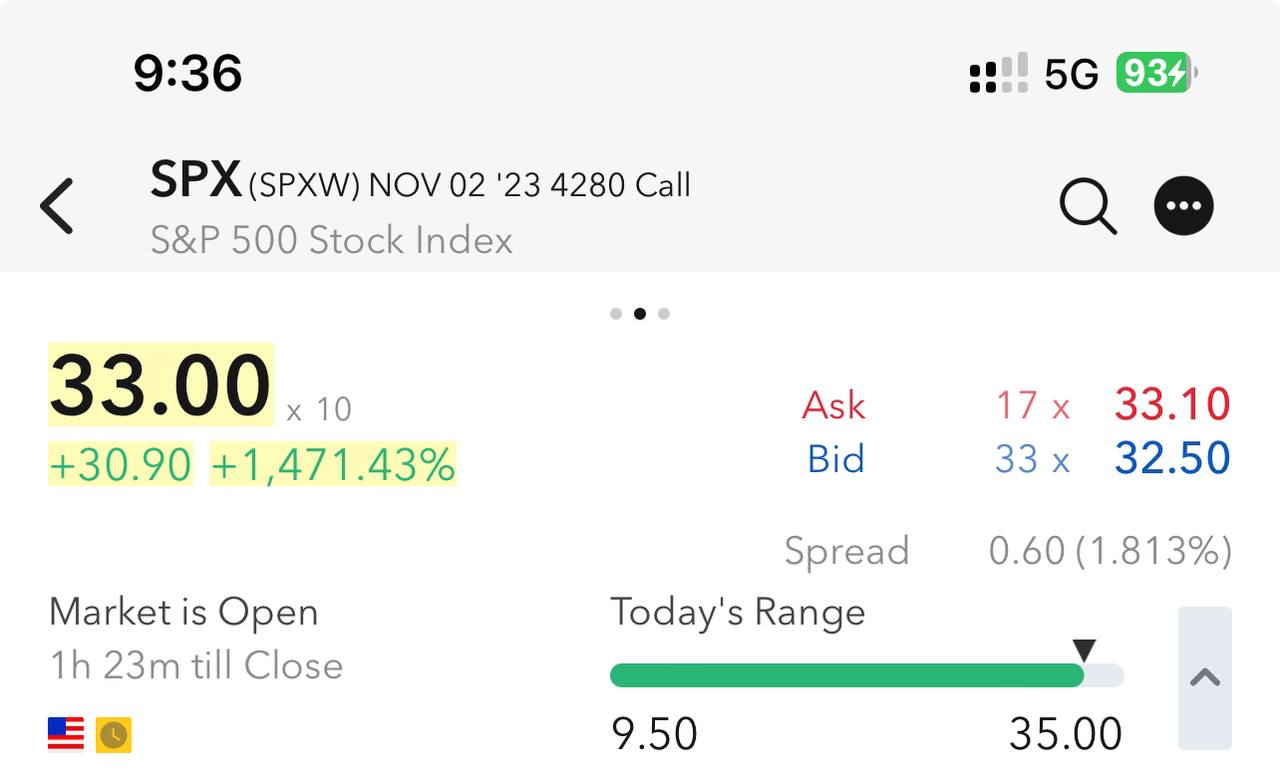

On the same day, Thursday, November 2, 2023, when our Cole 4280 Strike contract will expire, November 2, 2023, we monitored it continuously and constantly lifted the stop, and this is one of the risk management methods that every trader must adhere to.

The prices for both contracts became insanely high, and an hour and a half before the market closed on November 2, 2023, Thursday, we closed our deals for both contracts at the following prices:

- Note: Everything above is the results of experience in option trading and the basics of technical analysis, with the help of advanced LaBute indicators.

If you are interested in obtaining advanced Labot indicators, you can visit the packages page by clicking here